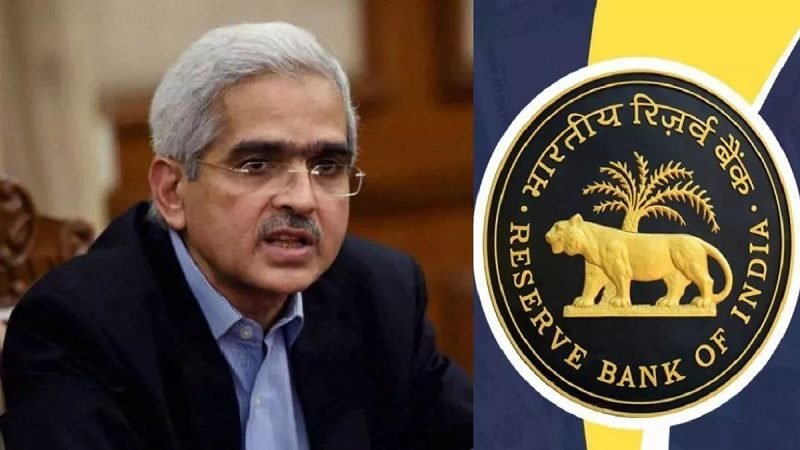

RBI Takes Action: ₹3.31 Crore Fine Imposed on J&K Bank, Canara Bank, and Bank of India for Rule Violations: The Reserve Bank of India (RBI) has taken significant action against three public sector banks on Friday, January 24, 2025. These measures were initiated due to non-compliance with regulatory guidelines. As a result, the RBI has reprimanded the banks and imposed fines amounting to a total of ₹3.31 crore.

Banks Penalized by RBI

- Jammu and Kashmir Bank: A fine of ₹3.31 crore was levied on J&K Bank for failing to adhere to Know Your Customer (KYC) guidelines.

- Bank of India: A penalty of ₹1 crore was imposed for not transferring funds to the education and awareness fund within the prescribed timeframe.

- Canara Bank: RBI fined Canara Bank ₹1.63 crore for non-compliance with guidelines on interest rates for priority sector loans, deposits, and financial inclusion initiatives.

Reasons Behind RBI’s Action

The RBI’s primary mission is to ensure the safety, transparency, and stability of India’s banking system. When banks deviate from the prescribed rules, the RBI intervenes to uphold the integrity of the financial sector, protect customers’ interests, and prevent misuse of the system.

Impact on Customers

These penalties have no direct impact on customers. However, if a bank’s license is revoked or its operations are restricted, customers might face challenges. In this case, the fines are corrective measures, and banking services will continue as usual.

This step by the RBI underscores its commitment to maintaining a robust and trustworthy banking ecosystem in India.